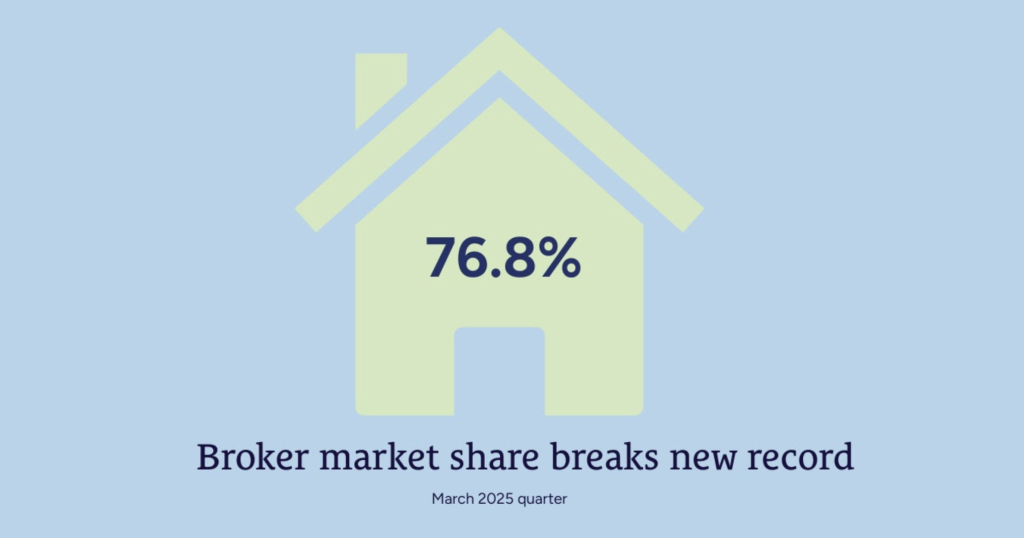

Something is shifting in the mortgage market and home buyers are taking notice. In the March 2025 quarter, mortgage brokers facilitated 76.8% of all new residential home loans, according to the Mortgage and Finance Association of Australia (MFAA). That’s up from 74.1% in March 2024 and 69.6% in March 2023. Over the same period, brokers settled $99.37 billion in loans – a 22% jump in value from the year before and the highest March quarter on record.

This consistent upward trend reflects more than just volume. It points to a broader shift: Australians are actively seeking expert guidance, tailored loan structures, more lender options and a personalised approach to finance – all areas where brokers excel.

A more competitive market

Following two interest rate cuts earlier this year, the lending market has become increasingly competitive. Banks and non-bank lenders are now offering sharper rates, cashback incentives and more flexible loan features to attract new borrowers.

While having more options is great, it can also make the process feel overwhelming, especially if you’re comparing different lenders, loan types or trying to refinance.

For many borrowers, the challenge isn’t just finding the lowest interest rate – it’s about choosing a loan product that aligns with their financial goals and personal circumstances. Lenders assess things like income, employment type and living expenses differently, which can affect the structure and suitability of your loan. A product that looks competitive now might limit your options later, especially if your situation changes.

This is where brokers come in. Rather than offering a one-size-fits-all product, a broker will look at your full financial picture and structure your lending around your goals. Whether you’re entering the market, refinancing or accessing equity, the right broker ensures your finance strategy supports your next move.

A matter of trust

Another reason more Australians are turning to mortgage brokers is trust. Brokers are legally bound by the Best Interests Duty (BID), which requires them to act in the best interests of their clients – not their commissions. This gives buyers greater confidence that the advice they receive is transparent, tailored and focused on their needs.

Banks and non-bank lenders aren’t held to the same standard. They only recommend products from their own range – which can be limiting, especially if you’re self-employed, have multiple income sources or don’t fit the standard borrower profile. While one lender may say no or offer restrictive terms, a broker can help you find one that’s a better fit.

This combination of choice, insight and personalised support gives borrowers a real advantage – especially when life, income or goals shift.

How Clever Finance supports today’s buyers

At Clever Finance, we don’t just arrange loans; we help investors grow their portfolios with clarity and confidence. Whether you’re buying your first investment property or expanding an established portfolio, we offer tailored finance strategies to support your goals.

We work with a wide range of investors – from first-timers to seasoned buyers – and take the time to understand your cash flow, borrowing structure and long-term plans.

With mortgage brokers now writing a record share of loans in 2025, it’s clear more investors are seeking smarter, more strategic lending advice – the kind we provide every day at Clever Finance.

Ready to take the next step with confidence? Book a call with us to discuss your goals and needs.