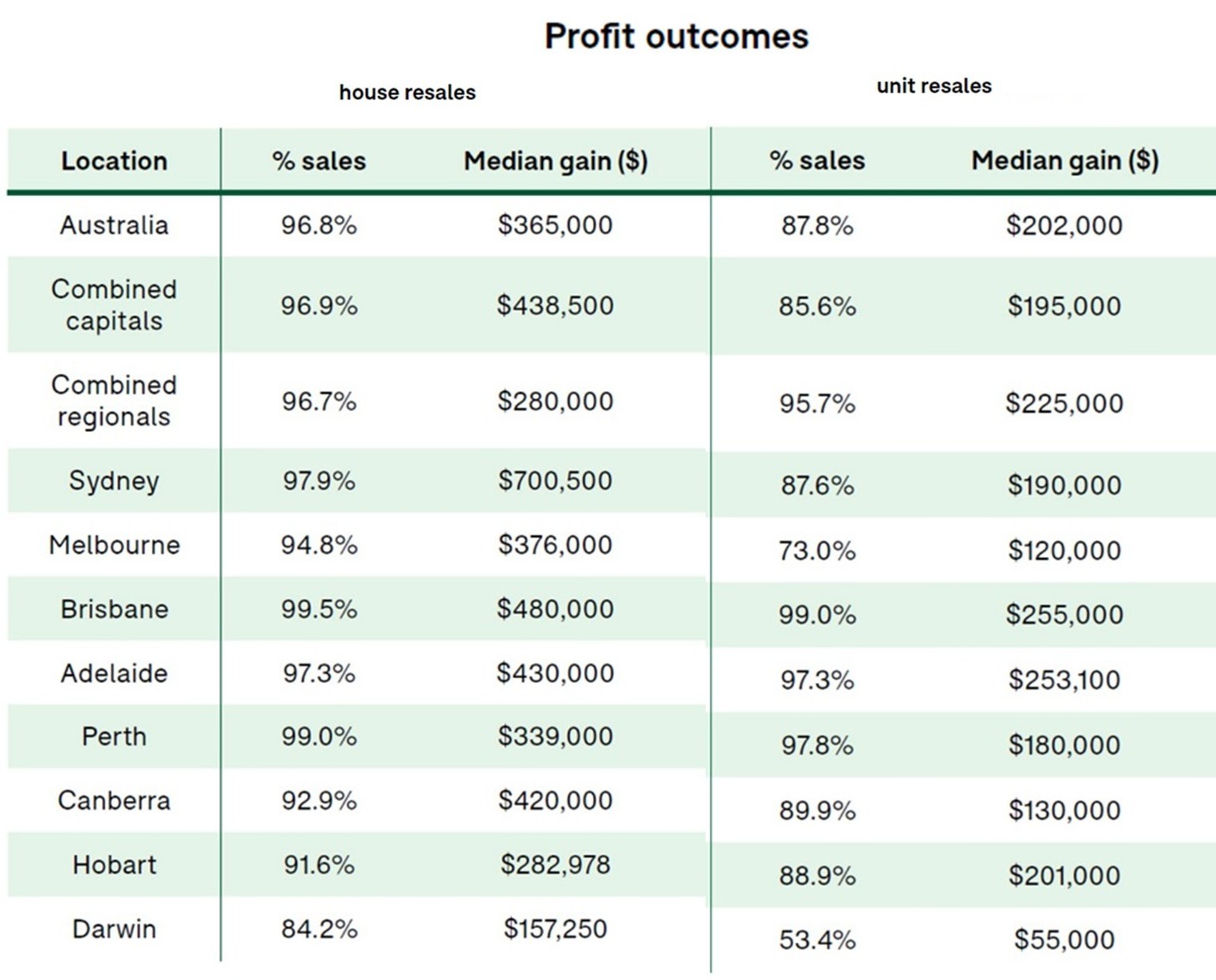

Australia’s property market has continued to reward investors in 2025, with almost all resales delivering a profit. According to Domain, 97% of house resales and 88% of unit resales in the first half of the year delivered gains.

These are the strongest results in two decades for houses and three years for units, underscoring how market momentum and longer ownership periods are combining to drive capital growth.

Median gross profits climbed to $365,000 for houses and $202,000 for units, both higher than a year earlier. In Brisbane and Perth, more than 99% of houses resold for a profit, while Sydney delivered the highest dollar-value returns, with a median gain of $700,500.

Regional markets have also shown strength, with 96.7% of houses and 95.7% of unit resales turning a profit. Lifestyle destinations such as regional Queensland and regional New South Wales have been among the best performers, attracting high-income buyers seeking affordability and larger homes.

Sydney houses doubling faster than units

Sydney offers a clear example of how houses are outperforming units over time. Cotality data shows it has taken just under 11 years for the city’s median house value to double to $1.53 million, compared with more than 16 years for units.

The difference comes down to land. As Cotality economist Kaytlin Ezzy explains, house prices are driven by the land beneath them, which is increasingly scarce. Units don’t share the same scarcity factor, as supply can be lifted through development.

Fast-doubling suburbs include Menangle Park, which took just 4.4 years to reach $1.15 million, while established prestige areas such as Bellevue Hill doubled to $10.6 million in nine years. For investors, this highlights how both development corridors and premium locations can deliver rapid equity growth.

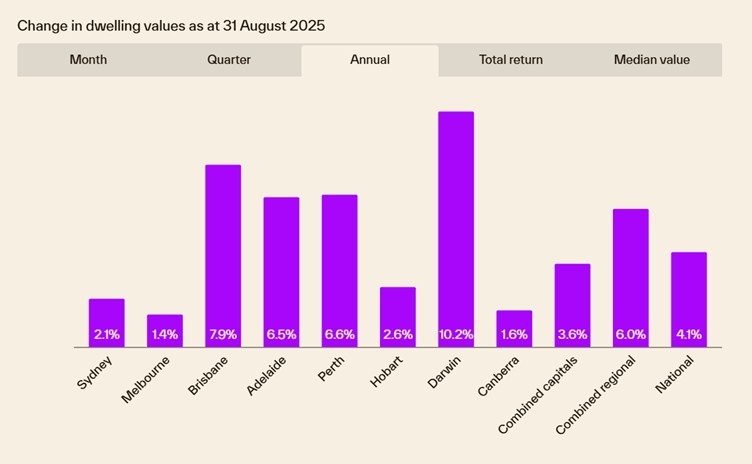

Home values continue to rise nationwide

The broader market has now logged 20 straight months of growth. National dwelling values rose 0.7% in August, the strongest monthly gain since May 2024, according to Cotality. That result pushed annual growth to 4.1%, with the median home gaining around $47,900 in value over the year.

Over the past five years, national prices have surged 50.4%, adding more than $350,000 to the typical home. This long-term growth has been reinforced by renewed momentum in 2025, where demand continues to outpace supply. Listings remain about 20% below average and clearance rates are at their highest since early 2024, creating strong competition among buyers.

Against this backdrop, Brisbane, Perth and Adelaide recorded the strongest monthly gains in August, while Darwin has emerged as the standout performer of the year, with values rising 10.8% in the first eight months.

Regional Australia closing the gap

Regional property markets are no longer just a secondary option – in many cases, they are outperforming the capitals. Over the past year, combined regional areas rose 5.9% compared with 3.0 % across the capitals, according to realestate.com.au.

Western Australia’s Geraldton topped the list with annual gains of 26.9%, while Albany recorded double-digit rental growth. In Queensland, Rockhampton properties sold in just 11 days, while Victoria’s Shepparton and Mooroopna posted a 30.3% increase in annual sales volumes.

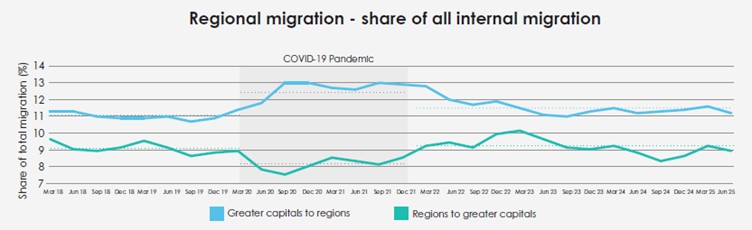

Migration trends remain a key driver. According to the Regional Movers Index for Q2, city-to-country moves are still elevated at levels about 17% higher than before the pandemic, reinforcing demand for lifestyle hubs and affordable regional centres.

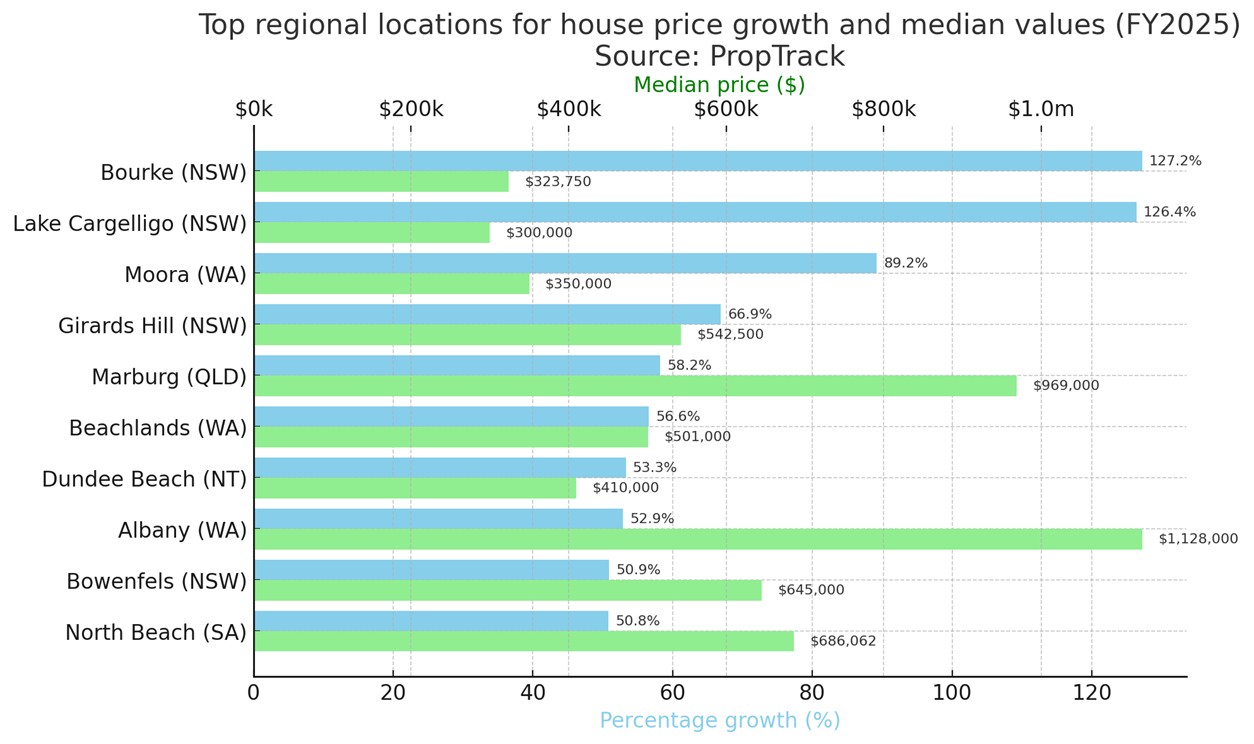

Regional suburbs outpacing metro

This trend has also helped more regional suburbs outperform their metropolitan counterparts, with PropTrack data showing that 1,672 regional locations recorded median house price growth over the past financial year, compared with 1,588 metro suburbs.

Almost 900 regional areas achieved double-digit growth, compared with fewer than 750 capital city suburbs. Relative affordability remains a core driver, with a national price gap of around $300,000 between city and regional homes. This continues to attract buyers seeking value for money, space and flexibility to work remotely.

Outlook for investors

Momentum in both capital cities and regional markets is expected to remain strong throughout 2025, supported by low supply, population growth and affordability differentials. For investors, the data reinforces the message that both established city markets and emerging regional centres are offering compelling opportunities to build equity and realise capital gains.

At Clever Finance, we help investors unlock equity, structure loans effectively and seize opportunities in both metro and regional markets. Whether you are expanding your portfolio or looking to refinance for your next purchase, our team provides tailored finance strategies that support long-term wealth creation. Book a call with us to take the next step in growing your investment portfolio.